Written by Frank Harrison, Chily de la Viesca and Edward Currie

The UK, a wealth giant with over £1.2 trillion in managed assets (that’s fifth in the world!), is seeing some interesting search trends in asset management. We’re diving deep into our Share of Searching data to see what big asset players and investors are looking for.

Here’s the scoop: generational wealth transfer and sustainable investing are taking centre stage. Let’s see what search trends reveal about these two hot topics!

We crunched the numbers on search trends for the UK’s top asset management companies: BlackRock, Vanguard, Royal London, Fidelity, Abrdn, Baillie Gifford, Invesco, Amundi and WisdomTree.

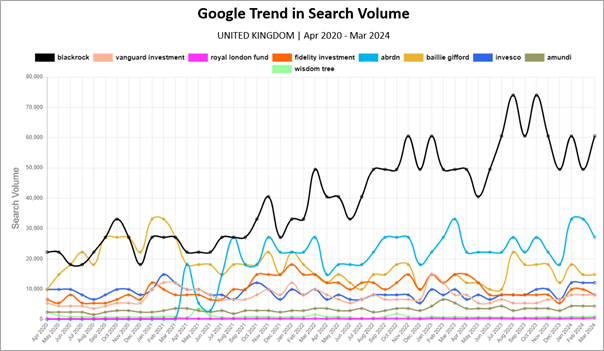

This chart shows the past four years of Google search volume for each company in the UK. See who’s trending and who’s not!

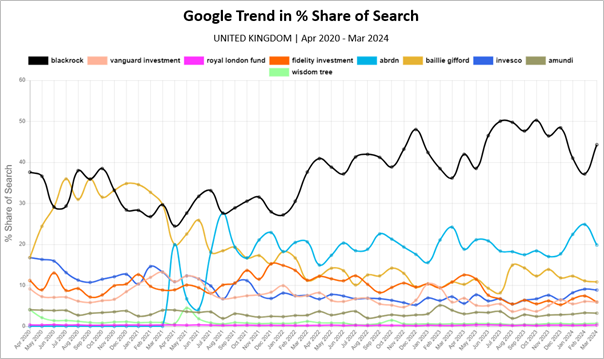

This chart reveals the monthly search market share for each company within this group.

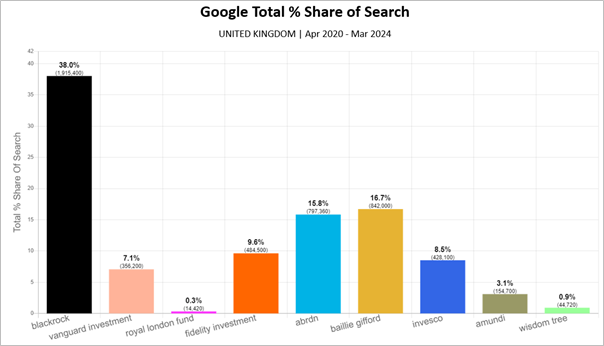

This chart tracks both the total search volume and search market share for the top UK asset management companies over the past four years. See who’s surging in popularity and who needs a rebrand (based on search data, of course!).

Our charts reveal some fascinating trends over the past four years:

BlackRock rules the roost: BlackRock dominates searches, clocking a whopping 50-75,000 searches monthly (40-55% share of search) – that’s triple what they saw four years ago! Their search dominance has skyrocketed from 28% in April 2021 to a commanding 44% in March 2024

Abrdn on the rise: Since the Standard Life Aberdeen rebrand to abrdn in 2021, searches have soard to around 30,000 per month, making them the second most-searched company in the group.

Baillie Gifford’s fall: Baillie Gifford’s search fortunes have taken a tumble, dropping from 33k searches in January 2021 to just 15k in March 2024. Their share of search also plummeted from 35% to a mere 11%.

What are people searching for?

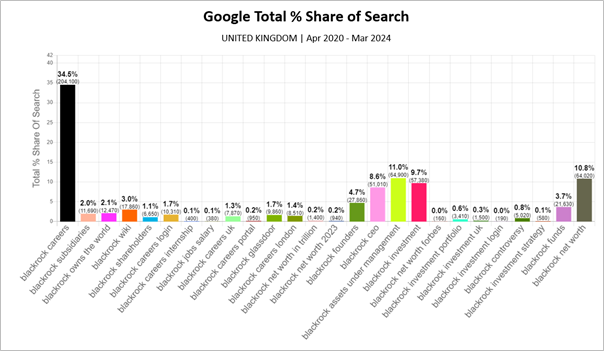

But what exactly are people looking for when they search for asset management companies? Interestingly, around 40% of searches are job-related, while 30% focus on investing.

Next up: BlackRock deep dive

Let’s take a closer look at BlackRock’s search landscape. We’ll explore search volumes and share of search for the most common terms people use when searching for this giant.

BlackRock isn’t just a financial giant, they’re a content powerhouse. Their website prioritises Expertise, Experience, Trustworthiness and Authoritativeness (E-E-A-T) across every page.

Hitting all the keywords: They craft solution pages that target both informational and transactional searches, capturing users at every stage of the investment journey.

Building trust: Common questions are answered head-on and social proof with links to studies bolsters their experience and trustworthiness.

Beyond text: BlackRock goes beyond articles. They’ve got explainer videos embedded throughout the site and even their own podcase, “The Bid”, which tackles the latest in investing.

This multi-format content strategy positions BlackRock as an industry authority, boosting brand awareness and organic search dominance. They’re not just managing investments, they’re managing the conversation.

Source: https://www.blackrock.com/uk

Source: https://www.blackrock.com/uk

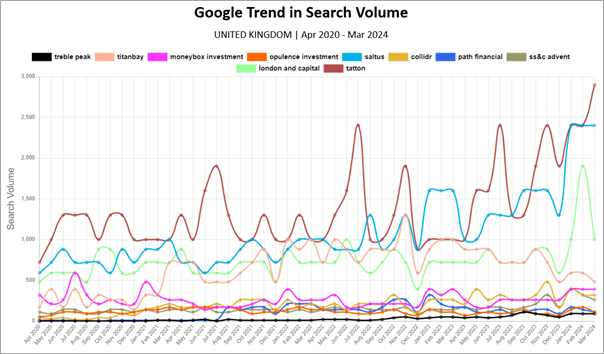

This chart dives into UK search trends for ten smaller asset management companies like Treble Peak, Moneybox and Collidr. See who’s making waves (and who’s not) in searches over the past four years.

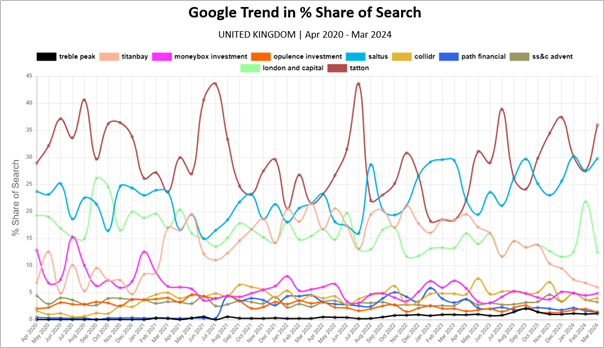

This chart reveals the monthly search share for each challenger brand, showing which smaller players are gaining ground.

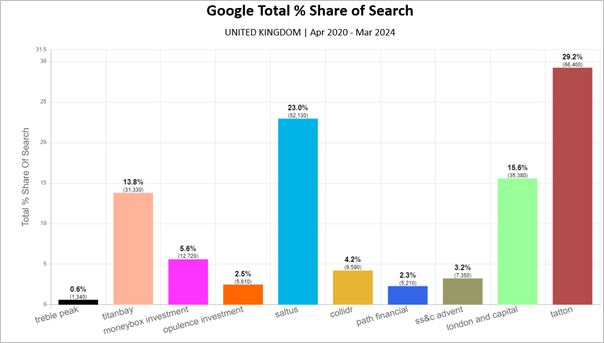

This chart tracks both the total search volume and search share for ten up-and-coming UK asset management companies over the past four years. See which challenger brands are surging in popularity (and who might need a marketing boost based on search data, of course!).

The chart reveals some surprising challengers emerging in the UK asset management scene:

Tatton takes the lead: Surging from a mere 700 searches in April 2020 to nearly 3,000 by March 2024, Tatton has captured the most search interest among these smaller companies. They consistently hold a 30-40% share of searches within this group.

Saltus steps up: Saltus isn’t far behind, also experiencing significant growth with searches rising from 600 to 2,900 in the same timeframe. They too maintain a strong 30-40% share of searches within the group.

London & Capital loses ground: While London & Capital initially saw decent search interest (500-1,000 searches/month), they’ve experienced a steady decline in share, dropping from 38% in October 2020 to just 19% in March 2024

Titanbay’s tumble: Titanbay seems to be losing steam, with search volumes dropping from 1,300 in November 2022 to a mere 480 last month.

The rest of the pack: The remaining companies in this group haven’t cracked the 500 monthly search mark yet.

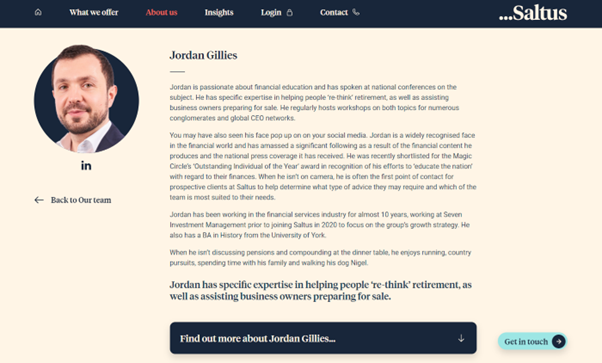

Saltus isn’t just climbing search rankings, they’re cracking the user trust code. Their secret weapon? E-E-A-T focussed content that tackles real user questions and concerns.

Pain points = content gold: They address user pain points with solutions, making them a valuable resource. But what makes their content stand out?

The author advantage: Saltus uses author pages linked to their content. These pages showcase the author’s education, qualifications and expertise. This transparency builds user confidence and tells Google the content is reliable (especially important for “Your Money Your Life” websites like asset management).

Content with credibility = search success: Saltus understands that E-E-A-T is crucial for organic search dominance in the YMYL space. By prioritising user needs and author expertise, they’re not just creating content, they’re building trust and authority – the perfect recipe for search success.

Source: https://www.saltus.co.uk/our-team/jordan-gillies

Source: https://www.saltus.co.uk/our-team/jordan-gillies

The asset management world is buzzing with two big, interconnected trends: generational wealth transfer and sustainable investing. Both are here to stay for decades, so buckle up! Here’s a deep dive into UK search trends for key topics related to these trends. Let’s see what’s on investors’ minds!

A tidal wave of wealth is flowing from boomers (age 60-78) to millennials (age 28-43). But these tech-savvy, sustainability-focussed heirs have different investment goals than their parents. Asset Managers, take note: adapt or get swept away!

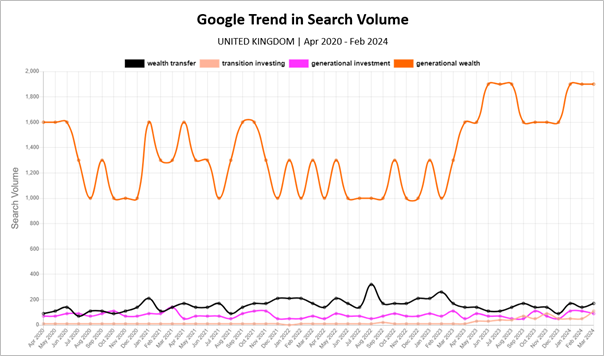

This chart tracks the rise of “generational wealth” searches, with a whopping 2,000 queries hitting Google each month. Looks like wealth transfer is a hot topic for future financial decision-makers!

The wealth transfer isn’t just about cash – millennials, the new moneybags, care about the planet too! This “green generation” is prioritising Environmental, Social and Governance (ESG) factors in their investments. Asset Managers better get on board – offering sustainable investment options is key to attracting these eco-conscious inheritors.

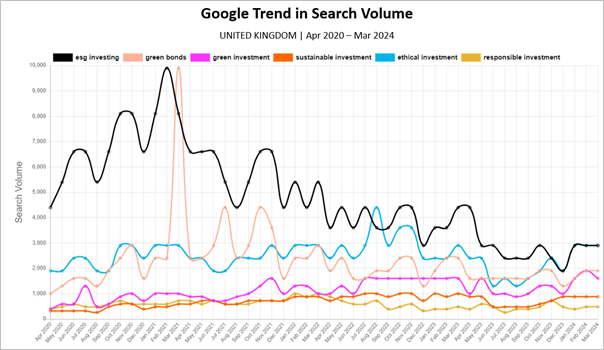

Sustainable investing is having a moment, but is it here to stay? Let’s see what search trends reveal:

So, is sustainable investing a fad? The data suggests it’s evolving, not disappearing. Asset Managers, take note: cater to this growing interest or risk getting left behind!

The asset management industry used to be all about handshakes and mahogany desks. But times are changing! Digitalisation is the new wave and firms are scrambling to build fancy online platforms for managing accounts, tracking investments and chatting with clients.

The early birds get the gains

The catch? Not everyone’s doing it well. Firms that nail digital tools are winning the tech-savvy millennial and Gen Z crowd. Here’s how to stay ahead of the curve: