It was a cold, wet start to the morning at 15 Queen Street. But sausage sandwiches and steaming pots of coffee soon warmed us up as we welcomed a table full of digital talent from across Scotland.

Our speakers for the morning were Jen Eastman from ForrestBrown and Adam Alton from Make it Social.

ForrestBrown are a team of chartered tax advisers specialising in R&D tax credits – and a partner of BIMA. They have a passion for digital but help innovative businesses from all sectors grow. Jen often travels back up to her native Scotland to see family and visit local clients.

Make it Social are a social ticket-buying platform based at local incubator CodeBase. They are a client of ForrestBrown and came along to share their experiences and promote the good-news stories that can come from R&D tax credits.

Around the table were attendees from a range of exciting Scottish digital companies including: Agency Core, Hot Tin Roof, Escrivo, Realise, Tayburn, Front Page, Dog, Stripe, iProspect, Whitespace, and xDesign.

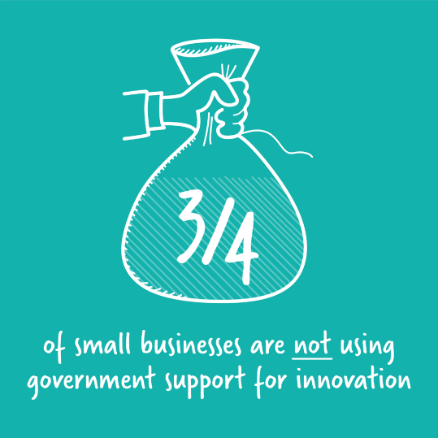

There are a number of options for funding innovation in your business. But not every business makes use of what’s on offer. To put frame this landscape, Jen led with some numbers. Recent research conducted by ForrestBrown found that:

• almost 90% of businesses plan to innovate in the next three years.

• 75% of small businesses are not using government support for innovation.

So whilst there is obviously an appetite for innovation and growth, many businesses are not accessing the support available. With R&D tax credits, SMEs can recoup up to 33p for every £1 spent on qualifying R&D. This can be in the form of a cash repayment and/or a corporation tax reduction. Just imagine… that’s money that could spark the next big project, or fund the final push in creating something remarkable.

The table discussed what types of activity can qualify for R&D tax credits. ForrestBrown have created an eligibility explainer video to help summarise what can be quite a confusing subject.

What better way to imagine the potential benefit of R&D tax credits than to hear from a business that is already claiming them. Adam explained that the growth of Make it Social was dependent on their ability to hire specialist employees to help them stay on the cutting-edge of their technological developments. And hires cost money. That’s where grants and R&D tax credits help.

“R&D has been vital for Make it Social. Encouraging our team to think outside the box has been a great way to solve complex problems and to ensure that we build technology that can beat the competition. ForrestBrown have been amazing at making sure that the R&D tax credits process takes up as little of our time as possible while creating a robust claim which maximises the amount we can put back into future R&D.” – Adam, Make it Social

The group had experienced varying fortunes with applying for grants. There have been mixed messages at times to the question: can grants and R&D tax credits be used together?. The simple answer is “yes”. The longer answer is, “it’s a little more complicated”, so it’s best to do your research before signing up to a grant. ForrestBrown go into the detail in their blog about grants and R&D tax credits.

The reaction from the roundtable towards R&D tax credits was positive. Many people were surprised by the range of activities that could potentially qualify. R&D tax credits really are a good news story for small businesses. As we’ve seen from research, and from this discussion, there is still a way to go in educating businesses about the benefits available to them and what projects can qualify. To learn more about the take-up of R&D tax credits in your sector, check out the latest statistics from HMRC.

• Identifying costs – We’ve seen some businesses restrict the qualifying costs they include in their claim to just the few written examples they’ve given, and not to their entire spend, meaning they miss out.

• External vs. internal projects – Some companies think they can’t include R&D undertaken on behalf of a client, and others that internal R&D projects don’t count. In fact, as long the work qualifies as R&D, you should be able to include them.

• Indirect costs – Assumptions are often made that qualifying R&D costs only include the time spent by technical staff working on relevant projects. But the impact of R&D activity on the wider business is often far greater – involving the coming together of project management and finance functions, and so on.

Thanks to Jen Eastman and Adam Alton for leading the round table and sharing their advice and experience. And a thank you too to everyone who attended and contributed to such a rich discussion.